Amara Raja Batteries Share Price Target 2025 se 2035: Ek Vistarit Vishleshan

Doston, agar aap stock market ke shauqeen hain, toh Amara Raja Batteries ka naam aapne zaroor suna hoga.: Yeh company India ke battery manufacturing sector mein ek bada naam hai, aur ab yeh Amara Raja Energy & Mobility Ltd ke roop mein naye horizons chhoo rahi hai. Aaj hum baat karenge iske share price targets ke baare mein 2025 se 2035 tak, saal dar saal ke projections ke saath. Yeh analysis aapko samajhne mein madad karega ki yeh stock aapke portfolio ke liye kitna promising ho sakta hai. Toh chaliye, ek-ek saal ka breakdown dekhte hain!

Company Overview

Pehle thodi si jaankari company ke baare mein. Amara Raja Batteries ki shuruaat 1985 mein hui thi, aur aaj yeh India ke top battery manufacturers mein se ek hai. Iska headquarters Tirupati, Andhra Pradesh mein hai, aur yeh lead-acid batteries ke saath-saath ab lithium-ion batteries aur energy storage solutions pe kaam kar rahi hai. “Amaron” brand toh aap sabne dekha hoga – yeh automotive batteries mein Exide ke baad doosra sabse bada naam hai. Company ab electric vehicles (EV) aur renewable energy ke sector mein bhi bada daav khel rahi hai, jo iske future growth ka ek bada driver hai.

Amara Raja Batteries Share Price Target 2025

2025 ke liye experts ka anuman hai ki Amara Raja ka share price ₹2200 se ₹2550 tak ja sakta hai. Aaj, 10 March 2025 ko, iska share price lagbhag ₹1300-1400 ke aaspaas trade kar raha hai (market ke hisaab se thoda upar-neeche ho sakta hai). Yeh jump kaafi promising hai.

Kyun Hoga Yeh Growth?

- EV Market: India mein electric vehicles ki demand tezi se badh rahi hai, aur Amara Raja lithium-ion batteries ke production mein bada role play kar rahi hai.

- Revenue: 2024 mein company ki revenue ₹17,000 crore ke aaspaas thi, aur 2025 mein yeh aur badhne ki sambhavna hai.

- Government Push: Modi sarkar EV adoption ko boost kar rahi hai, jo iske liye ek bada plus hai.

Risks: Raw material jaise lithium ke daam badhne se cost pe asar pad sakta hai, lekin company ka management isse handle karne mein saksham hai.

Amara Raja Batteries Share Price Target 2026

2026 mein share price ₹3000 se ₹3360 tak ja sakta hai. Yeh ek bada leap hai, aur iske peeche kaafi solid wajahen hain.

Growth Factors:

- Innovation: Company apne R&D pe dhyan de rahi hai, aur naye battery solutions la rahi hai.

- Sales Badh Rahi Hai: 2023 mein ₹2882 crore ki sales thi, jo 2024 mein ₹3136 crore ho gayi. Yeh trend continue kar sakta hai.

- Global Reach: Amara Raja ab international markets mein bhi apna naam bana rahi hai.

Challenges: Competition badh raha hai, lekin Amara Raja ki positioning isse aage rakhegi.

Amara Raja Batteries Share Price Target 2027

2027 ke liye target ₹3900 se ₹4120 tak hai. Yeh saal company ke liye ek turning point ho sakta hai.

Kya Drive Karega?

- Green Energy: Battery recycling aur sustainable solutions pe focus margins ko improve karega.

- EV Boom: 2027 tak India mein EV market aur mature hoga, aur Amara Raja isme lead le sakta hai.

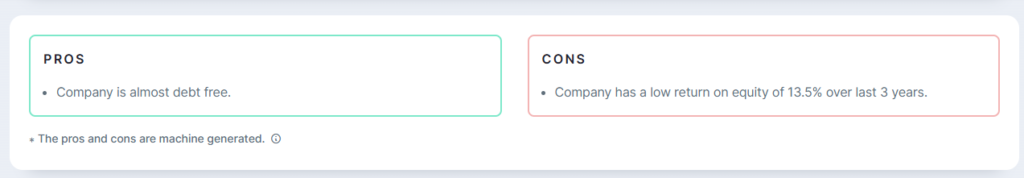

- Debt-Free: Company ka zero debt status investors ko confidence deta hai.

Risks: Global supply chain issues ya regulatory changes thoda asar daal sakte hain.

Amara Raja Batteries Share Price Target 2028

2028 mein share price ₹4800 se ₹5000 tak ja sakta hai. Yeh ek mid-point hai humare 2025-2035 ke analysis ka.

Key Points:

- Energy Storage: Solar aur wind projects ke liye batteries ki demand badhegi.

- Partnerships: EV manufacturers ke saath tie-ups revenue ko diversify karega.

- Profitability: Cost-efficient production se margins aur behtar honge.

Dhyan Rakhne Wali Baat: Competition aur raw material volatility ab bhi risks hain.

Amara Raja Batteries Share Price Target 2029

2029 ke liye target ₹5500 se ₹5700 hai. Yeh ambitious hai, lekin company ka track record isse possible banata hai.

Growth Ka Raasta:

- Export: International business kaafi strong ho sakta hai.

- New Tech: Solid-state batteries jaise innovations company ko edge de sakte hain.

- Demand: EV aur energy storage ki global demand peak pe hogi.

Risks: Strict environmental laws production cost badha sakte hain.

Amara Raja Batteries Share Price Target 2025 se 2035:

Amara Raja Batteries Share Price Target 2030

2030 mein target ₹6000 se ₹6280 tak hai. Long-term investors ke liye yeh ek sapna pura hone wala scenario hai.

Kyun Hoga Yeh?

- Market Leader: Battery industry mein top position sambhav hai.

- Sustainability: Green energy projects isse unstoppable bana sakte hain.

- Financials: Consistent revenue growth valuation ko boost karega.

Challenges: Technological disruptions ya geopolitical tensions raw material supply ko affect kar sakte hain.

Amara Raja Batteries Share Price Target 2031

2031 mein share price ₹6500 se ₹6800 tak ja sakta hai. Yeh ek gradual growth dikhata hai.

Factors:

- EV Maturity: India aur global markets mein EV adoption peak pe hoga.

- Tech Upgrades: Battery efficiency aur durability mein improvements.

- Stable Economy: Agar market conditions stable rahe, toh yeh target realistic hai.

Risks: Economic slowdown ya competition ka pressure.

Amara Raja Batteries Share Price Target 2032

2032 ke liye target ₹7000 se ₹7300 hai. Yeh saal company ke liye consistency ka proof hoga.

Key Drivers:

- Global Expansion: Export markets mein aur growth.

- Renewable Energy: Solar aur wind energy storage ka bada share.

- Investor Trust: Long-term performance se confidence badhega.

Risks: New competitors ya raw material scarcity.

Amara Raja Batteries Share Price Target 2033

2033 mein target ₹7500 se ₹7800 tak hai. Yeh ek steady upward trend dikhata hai.

Kya Hoga Special?

- Innovation Lead: Battery tech mein Amara Raja leader ban sakta hai.

- Diversification: Naye sectors jaise aerospace ya defense mein entry.

- Profits: High margins se valuation aur badhegi.

Challenges: Regulatory hurdles ya global economic shifts.

Amara Raja Batteries Share Price Target 2034

2034 ke liye target ₹8000 se ₹8300 hai. Yeh ek strong growth phase ka hissa hoga.

Growth Ka Raasta:

- Sustainability Goals: Carbon-neutral production se brand value badhega.

- Demand Surge: Energy storage aur EV ki zarurat aur bhi badhegi.

- Financial Health: Debt-free status maintain rahega.

Risks: Tech disruptions ya supply chain bottlenecks.

Amara Raja Batteries Share Price Target 2035

2035 mein target ₹8500 se ₹8800 tak ja sakta hai. Yeh long-term vision ka culmination hoga.

Kyun Hoga Yeh?

- Global Giant: Amara Raja ek international battery powerhouse ban sakta hai.

- Next-Gen Tech: Advanced batteries jaise solid-state ya graphene-based solutions.

- Market Domination: India aur abroad mein strong presence.

Risks: Geopolitical tensions ya raw material ki kami.

Amara Raja Batteries Share Price Target 2025 se 2035:

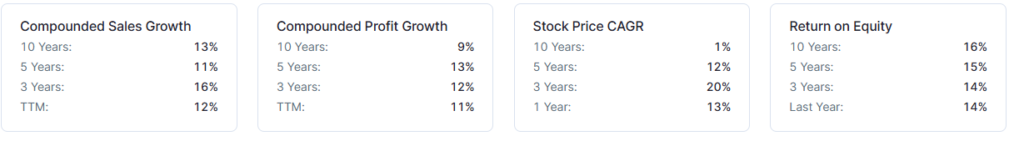

Key Metrics (March 2025 Tak)

- Revenue: ₹17,000 crore (2024)

- Profit Margin: 7-8%

- ROE: 13.5% (past 3 years average)

- Debt: Zero

- Market Cap: ₹23,000 crore ke aaspaas

Peer Comparison

Exide Industries se comparison karein toh:

- Market Share: Exide thoda aage hai, lekin Amara Raja EV mein fast catch-up kar rahi hai.

- Growth Rate: Amara Raja ki revenue growth Exide se better hai.

- Innovation: Lithium-ion aur sustainability mein Amara Raja aage hai.

Summary of Share Price Targets

- 2025: ₹2200 – ₹2550

- 2026: ₹3000 – ₹3360

- 2027: ₹3900 – ₹4120

- 2028: ₹4800 – ₹5000

- 2029: ₹5500 – ₹5700

- 2030: ₹6000 – ₹6280

- 2031: ₹6500 – ₹6800

- 2032: ₹7000 – ₹7300

- 2033: ₹7500 – ₹7800

- 2034: ₹8000 – ₹8300

- 2035: ₹8500 – ₹8800

FAQs

- Kya Amara Raja mein invest karna safe hai?

Haan, long-term ke liye yeh safe hai, lekin market risks pe nazar rakhni hogi. - 2035 tak kitna return mil sakta hai?

Agar aap aaj ₹1400 pe invest karte hain aur 2035 mein ₹8800 tak jata hai, toh yeh 500-600% return ho sakta hai. - EV market ka kya impact hoga?

EV boom Amara Raja ke liye bada growth driver hai. - Risks kya hain?

Raw material prices, competition, aur regulatory changes.

Conclusion

Doston, Amara Raja Batteries ek aisa stock hai jo aane wale das saalon mein bada dhamaka kar sakta hai. EV aur renewable energy ka future bright hai, aur yeh company isme bada role play karne wali hai. Lekin stock market mein hamesha thodi si uncertainty hoti hai, toh apne financial advisor se salah zaroor lein. Aapke vichar kya hain? Comment mein batayein!